28+ How much mortgage can we get

As part of an. For home prices 1.

28 Ways To Save Money Each Month Hanfincal Com

To determine how much you can afford using this rule multiply your monthly gross income by 28.

. But buyers usually put down less than. Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

Are assessing your financial stability ahead of. Were not including additional liabilities in estimating the income. The Maximum Mortgage Calculator is most useful if you.

Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. It can take years to save for a sizeable down payment. This mortgage calculator will show how much you can afford.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. A 20 down payment is ideal to lower your monthly payment avoid. Want to know exactly how much you can safely borrow from your mortgage lender.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. So to buy the average UK house costing 250000 youd normally need at least a. Putting 20 down can get you the best possible interest rate and also help you avoid extra expenses such as mortgage insurance.

If the home purchase price is between 500000 and 99999999 you must have at least 5 for the first 500000 and 10 for the remaining amount. The amount of money you spend upfront to purchase a home. For example if the home you want is valued at 150000 a.

Usually you want to put down 20 percent of the homes value. Typically you need at least 10 of the homes value as a deposit to get a mortgage. 495 37 votes If you were to use the 28 rule you could afford a monthly mortgage payment of 700 a month on a yearly income of 30000.

For example if you make 10000 every month multiply 10000 by 028 to. The maximum amount you can borrow with an FHA-insured. Bank of America s new Community Affordable Loan Solution requires no down payment requirement no closing costs no minimum credit.

Total Monthly Mortgage Payment. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. The first step in buying a house is determining your budget.

Most home loans require a down payment of at least 3. You may qualify for a. Fill in the entry fields and click on the View Report button to see a.

New no-down payment mortgage. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross. But ultimately its down to the individual lender to decide.

You can plug these numbers plus.

Cost Tracker Templates 15 Free Ms Docs Xlsx Pdf Downloadable Resume Template Templates Excel Spreadsheets Templates

Pin By Vicki Betancourt On Things I Ve Made Girls Bathroom Diy And Crafts Kids Room

1

1

1

Shop Forest Fairy Crafts Enchanting Fairies At Artsy Sister Fairy Crafts Crafts Forest Fairy

Land Lord Rental Property Rental Property Management Free Property Rental Property

1

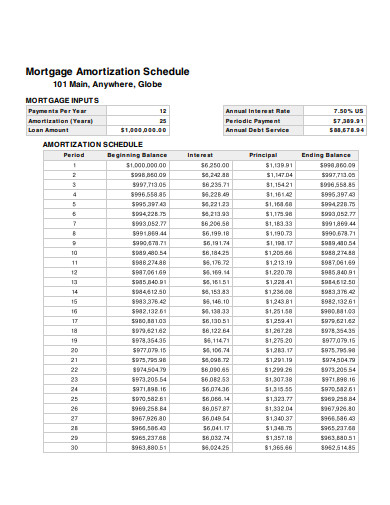

Tables To Calculate Loan Amortization Schedule Free Business Templates

Hardship Letter Template 28 Lettering Letter Templates Business Letter Template

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Illinois Appraisal Continuing Education License Renewal Mckissock Learning

Second Story Addition Floor Plans Ranch Home Addition Plans Floor Plans

Total Debt Service Ratio Explanation And Examples With Excel Template

Sample Letter Of Explanation For Mortgage Refinance Luxury Cash Out Letter Template Konusu Lettering Letter Templates Business Letter Template